Taxpayer Benefits of Massachusetts Income Tax Rate Reduction

You can read the full report complete with footnotes here.

Executive Summary

Massachusetts currently imposes a 5% income tax on its residents. This policy brief examines a proposed reduction to 4%, a change that could deliver financial relief to taxpayers while stimulating broader economic growth. Our analysis of the potential impact finds that a 1 percentage point cut would:

- Save the average Massachusetts taxpayer roughly $1,336 annually compared to the status quo; and

- Increase state GDP by as much as $17.5 billion within three years of the full tax cut.

Introduction

The Bay State is known for its excellence in education, innovation, and its strong economy that drives opportunity across the region. Despite these strengths, Massachusetts residents and businesses face mounting financial pressures, including a high cost of living, rising housing prices, and extensive taxes. The state faces a growing challenge as residents and businesses are leaving or considering leaving Massachusetts due to high taxes. Recent Mass Opportunity Alliance polling showed that 82 percent of residents believe high taxes are driving people out of the state.1 In fact, Massachusetts experienced a net loss of 45,000 residents in 2022, and roughly two-thirds of individuals said the state’s tax environment was a factor pushing people to move out of the state.2

These findings highlight widespread frustration with the current tax burdens and the idea that Massachusetts is becoming increasingly unaffordable for working families, recent graduates, and retirees alike. To address these challenges, our initiative proposes reducing the state’s personal income tax rate from 5% to 4% over a three year period. The one percentage point cut aims to put money back into taxpayers’ pockets while positioning Massachusetts for better long-term economic growth.

Data & Findings

- Massachusetts taxpayers could save an average of $1,336 annually upon full implementation of the 4% income tax rate.

To understand how a tax cut would impact resident taxpayers, we simulated estimates of income tax collections under the current 5% rate as well as the proposal to fully cut that rate down to 4%. These estimates are based on each tax rate applied to total taxable income levels for each income bracket. These taxable income levels were extrapolated using the latest year of data (2022) from the Internal Revenue Service based on the 10-year historical growth rate by income bracket.

Taxpayer savings estimates are based on U.S. Internal Revenue Service Statistics of Income (SOI)3 data from 2010 through 2022, the most recent year available. This dataset provides detailed individual income and tax data by state, including the number of returns filed and total taxable income in Massachusetts. Using historical growth trends, we projected taxable income and the number of tax returns in future years to estimate taxpayer savings under a phased tax cut, beginning with a one-third percentage point reduction in 2027 until reaching a full 1% cut by 2029.

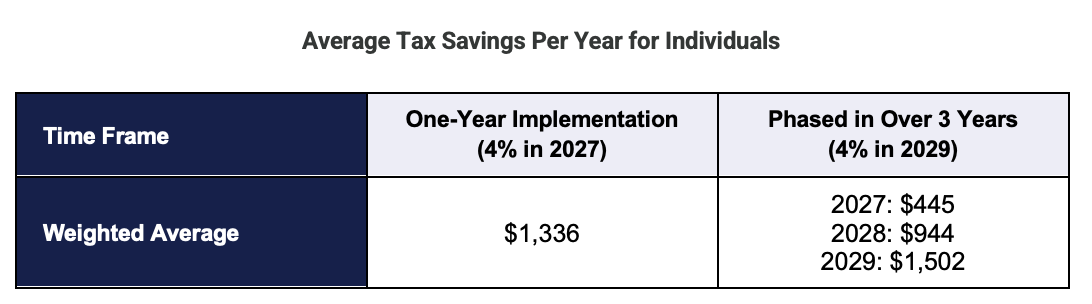

While the amount of savings will vary depending on individual levels of taxable income, the model shows tax savings for all Massachusetts taxpayers. Developing a weighted average by the number of tax returns in each income bracket, the average Massachusetts taxpayer would keep $1,336 annually in their pockets following an income tax rate cut from 5% to 4%.

The data shows that reducing Massachusetts’ income tax rate from 5% to 4% would result in significant tax savings for residents across all income levels. Based on projected taxable income estimates and number of tax returns, the cut to a 4% income tax rate would save the average Massachusetts taxpayer roughly $1,336 per year. In addition, if the tax cut were to be phased in over a three year period, the average taxpayer could save roughly $3,000 dollars by the time the full cut takes effect.

Added together, an income tax cut would yield billions in savings for all Massachusetts taxpayers. Based on projected 2027 taxable income estimates, an income tax rate reduction from 5% to 4% in 2027 would save roughly $4.81 billion for taxpayers that year compared to the status quo 5% rate. The same reduction phased in over three years, reaching 4% by 2029 would save taxpayers roughly $10.5 billion across those three years compared to the status quo.

- Massachusetts GDP could increase by up to $17.5 billion in the years following full implementation of the 4% income tax rate.

Our economic model draws on several empirical studies that examine the macroeconomic effects of income tax reductions. These studies typically assess the short- and long-term impacts of a full, immediate 1 percentage point cut in the average personal income tax rate, and find GDP increases ranging from 0.5% to 2.5% over time. Projected changes in GDP were calculated using data from the U.S. Bureau of Economic Analysis (BEA),4 focusing on the period from 2000 onward to estimate the impact of the proposed tax cut. To calculate the change in Massachusetts’ GDP, we calculated the average growth rate in GDP over the past 24 years. Using this growth rate, we projected the GDP for 2026 under a baseline scenario without policy changes. Then, drawing on prior research, we applied a range of estimated impact factors to model how a 1 percentage point reduction in the state income tax rate could influence the 2029 GDP (once the full tax cut is implemented), producing a range of potential GDP outcomes reflecting the tax cut’s economic effect.

To capture the responsiveness of state-level economic growth to changes in the income tax rate, we rely on elasticity estimates from economic literature studying income tax reductions. The studies were selected based on their methodologies and relevance to our proposed tax cut initiative in Massachusetts. The elasticities in these studies measure how responsive economic variables (i.e., GDP) are to changes in tax rates. While the elasticities vary across studies, their range provides a useful framework for modeling potential outcomes under different behavioral assumptions. The following summary table presents key elasticity estimates used in this analysis, along with brief descriptions about each study’s approach and context.

While our proposal ultimately targets a similar 1 percentage point reduction (from 5% to 4%), it is expected to be phased in gradually over three years, with full implementation by 2029. To account for this, we modeled GDP effects under two scenarios: (1) the impact in the first year, when the cut is only partially (1/3) in effect, and (2) the impact after three years, once the full 4% rate is implemented.

The results show that in the first year of a phased-in tax cut, Massachusetts could see a boost in GDP between $227.9M and $455.9M. This would represent an increase from a projected baseline GDP of approximately $890.9 billion in 2027.

As the tax cut is fully phased in (tax rate is 4%), the effects grow substantially. The immediate (within a quarter) gains post-implementation range from $669.9M to $1.3B while the short-term effects (less than a year) could reach between $7.6B and $13.6B.

Over the longer term (one to three years after full implementation), the state’s GDP is estimated to increase by $14.6 billion to $17.5 billion, relative to a projected 2029 baseline GDP of $972.9 billion.

Cutting Massachusetts’s income tax rate can boost GDP and save taxpayers money without necessarily requiring budget cuts. Economic research shows that allowing taxpayers to keep more of their income increases their disposable income, which drives higher consumer spending. This increased spending and investment has a compounding effect over time, fueling continued growth in the local economy. As a result, the state captures more revenue through sales taxes from consumer purchases, corporate taxes on increased business activity, and taxes on investment transactions in the years following the income tax cut and GDP boost. Overall, the increase in economic activity from higher disposable income due to an income tax cut could bring greater economic prosperity and competitiveness to the Commonwealth.

Limitations

The studies informing our model generally analyze the macroeconomic impact on tax reductions using similar approaches, focusing on changes to average tax rates and their effects on GDP growth over time. However, they differ in aspects such as type of tax change measures (e.g., statutory tax rate vs. total tax-to-GDP ratio), timing assumptions (immediate vs. phased implementation), and geographic scope (national versus state-level analysis).

It is important to note that two studies conducted by Cloyne, which informed our model, differ from the others in that they estimate the effects of a one percentage point reduction in taxes as a share of GDP, rather than a direct cut in income tax rates. To apply their findings to our state-level analysis, we translated our proposed rate reduction into an equivalent change in the tax-to-GDP ratio and applied Cloyne’s elasticities to approximate the potential impact on Massachusetts GDP.

While this provided a useful estimate of GDP growth, the elasticities from Cloyne’s studies don’t directly translate into specific dollar impacts without adjustment. Although the methodologies are not directly comparable, this transformation allowed us to use their results as supporting evidence for the broader economic benefits of lowering a state’s overall tax burden.

Conclusions

High taxes are making it harder for Massachusetts residents and their families to afford to live in the state. One way to alleviate this pressure is by reducing the state’s income tax rate—making it more likely that people will remain in Massachusetts while continuing to contribute to the local economy. Our analysis of a proposed 1 percentage point reduction shows that the average taxpayer could save over $1,600 annually, while the state’s GDP could grow by up to $17.5 billion after a few years. At a time when both residents and businesses are reevaluating their futures in Massachusetts, bold tax reform like this can help keep the state competitive and economically resilient.