Taxpayer Benefits Of Massachusetts Revenue Cap Revision

You can also read the full report complete with footnotes here.

Executive Summary

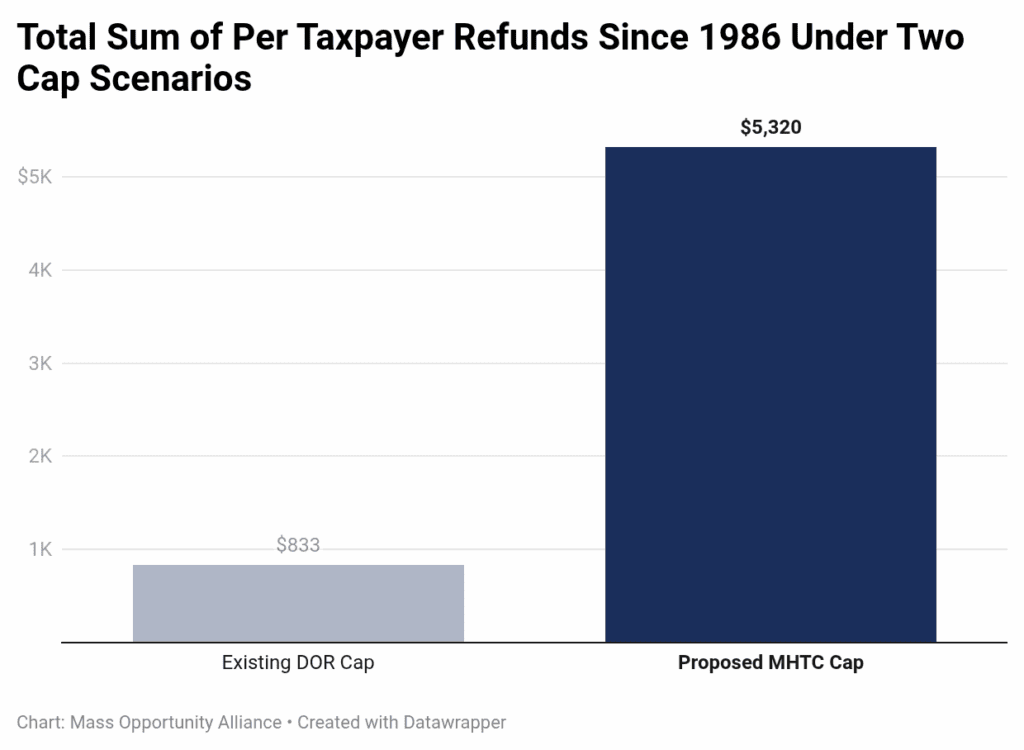

- Under the current revenue limit calculation, Massachusetts taxpayers have only received two refunds in the last four decades. This amounts to roughly $833 per taxpayer in the history of the law.

- The current revenue cap has not constrained budget growth, instead budget spending levels have grown at nearly double the rate of Massachusetts average wages and local inflation.

- Under the revised revenue limit rooted in actual tax collections, Massachusetts taxpayers would have received a refund 24 times in the last four decades. This amounts to nearly $19 billion in taxes that should have been given back to taxpayers.

- Every year, the amount that would have been refunded would be different, but the average Massachusetts taxpayer could have received roughly $5,320 if they lived and paid taxes in Massachusetts for the last four decades.

- Based on this history, Massachusetts taxpayers can expect to receive thousands of dollars in future excess revenue refunds under the proposed change to the revenue cap.

Introduction

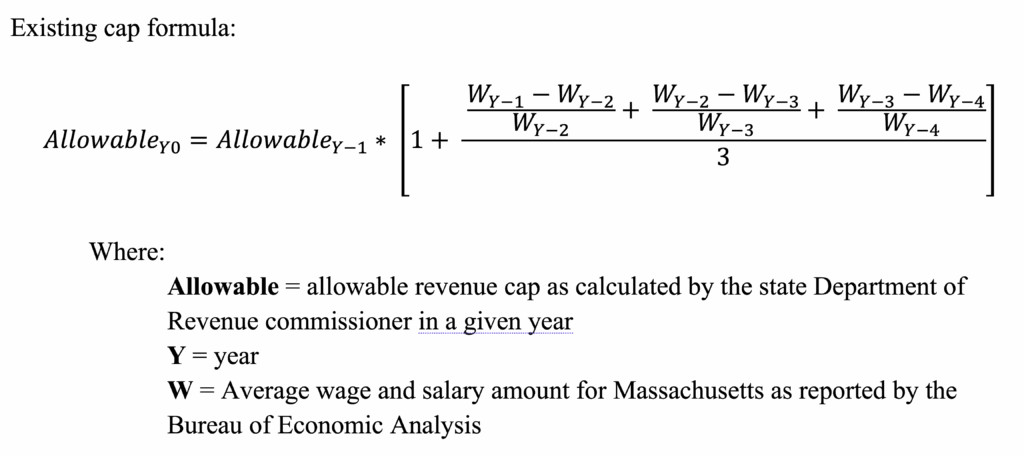

Back in 1986, Massachusetts voters passed a law proposed by the Massachusetts High Tech Council (MHTC) to try to promote fiscal responsibility by calculating how much every year the state was allowed to collect in taxes, starting with 1986 actual revenue, adjusted for wage growth every year. If collections surpassed this calculation, done annually by the state Department of Revenue commissioner, the law said any excess revenues must be refunded to taxpayers. The goal of the law was to prevent the state government from over-collecting and over-spending without taxpayer consent, while keeping revenue and spending tied to economic growth. Currently, Massachusetts is one of 19 states that have a limit on how much the state government can collect in taxes, many of which use economic indicators such as personal income, inflation, or population change to limit growth of the cap. Massachusetts’ current cap calculates growth for a given year by a three-year average growth in average Massachusetts wage and salary levels as measured by the Bureau of Economic Analysis.

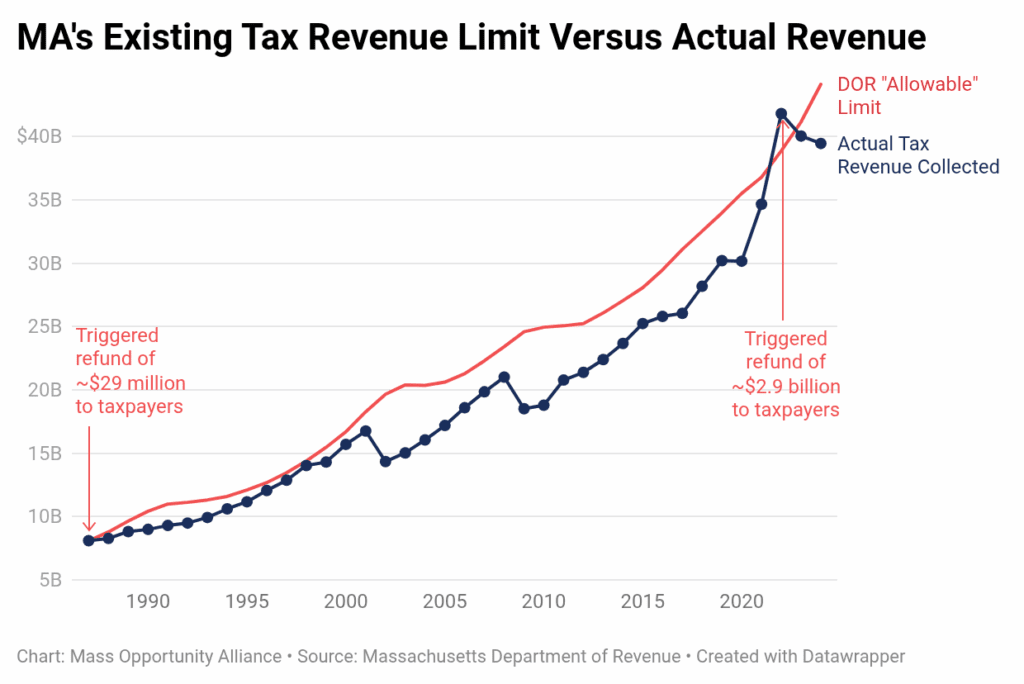

This calculation capping “allowable” state revenues was enacted to constrain the amount of revenue lawmakers could count on to spend in annual budgets. However, it has rarely ever been triggered in its four-decade history. This is because the current method calculates an overly high limit, based on the calculated cap – or highest possible revenue amount “allowable” – from the year prior, which is then increased by the amount of wage and salary growth over the previous three years. This allowable revenue calculation began in 1987 using 1986 actual revenue plus the last three years of actual wage and salary growth.

This formula does not consider that tax collections from the previous year may have been lower than this “allowable” amount. As a result, basing future years’ allowable limits based on a larger-than-actual revenue amount inflates those future year limits, potentially leaving room for the state to collect significantly more in taxes in future years than it needs with artificially high limits.

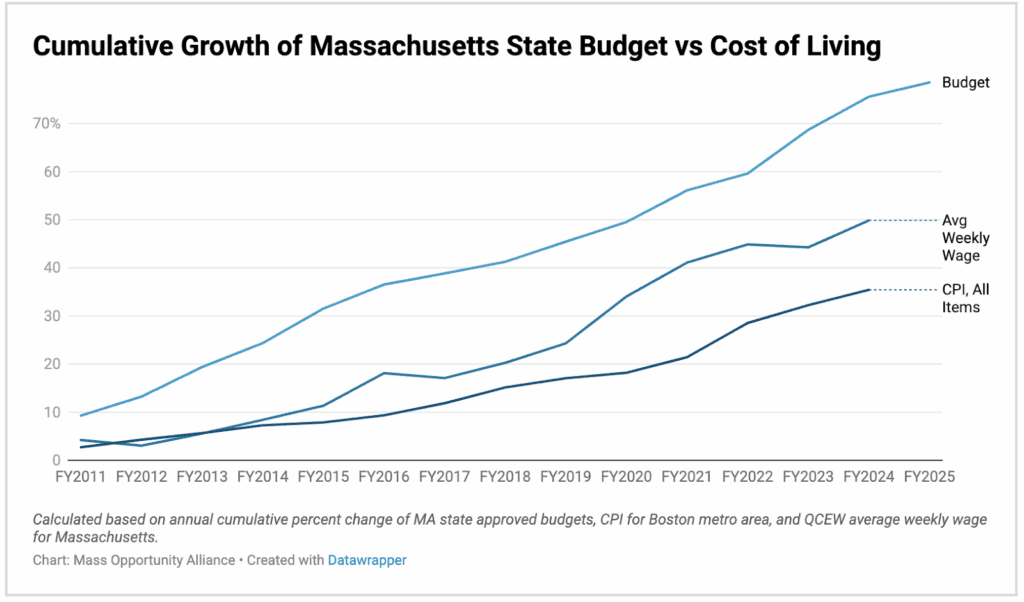

State tax collections have indeed jumped significantly over the past four decades, and the existing cap has not constrained Massachusetts’ budget growth. Since 2010, Massachusetts approved budget spending has grown by 114%, faster than the rate of wages (62%) and even faster compared to inflation (42%).

While the original cap was well-intended, additional adjustments to the law would make it more effective at capping revenue, and therefore spending, and provide taxpayers with more refunds of excess revenue dollars.

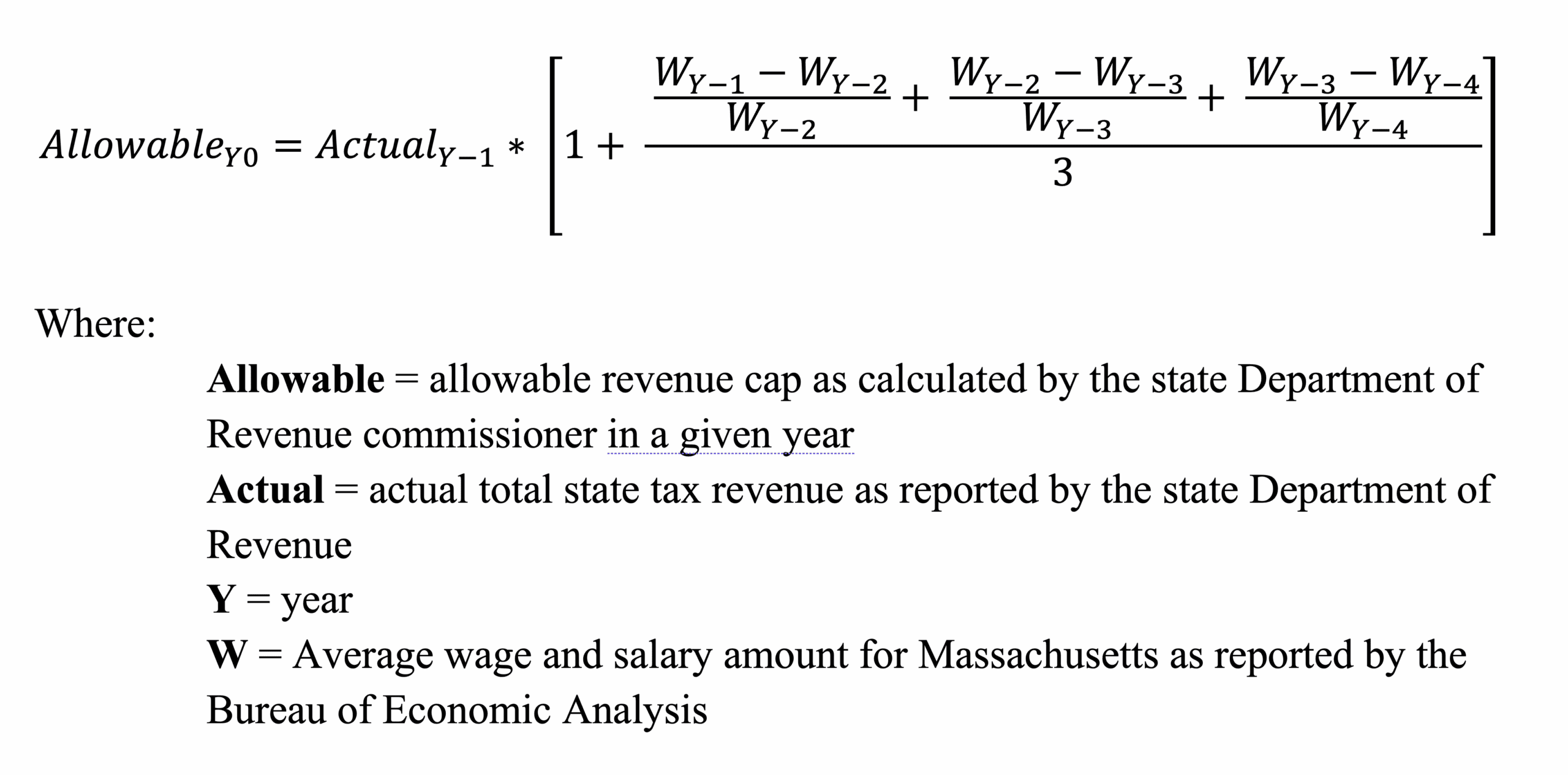

A revised proposal by the Mass High Tech Council (MHTC) would change the way the cap limit was calculated to instead be rooted in real-time Massachusetts revenue. MHTC proposes revising the revenue cap to be based on actual collected revenue from the prior year, adjusted for economic growth, instead of the allowable revenue limit calculated in the prior year. This provides a more sustainable growth model for state revenues,2 and ensures taxpayers do not suddenly find themselves on the hook for increased budget spending well above previous years’ levels.

This analysis looks at the current law’s revenue cap and how it has affected taxpayers, compared to how this revised proposal would stack up with existing tax collections by year. From this, we estimate the revision could return more dollars back into taxpayers’ pockets.

Findings

To understand the impacts of tying the existing revenue limit to actual tax collections, we estimate what the MHTC cap would have looked like every year since 1986 using Department of Revenue-reported revenue amounts, and where excess values would have been returned to taxpayers.

In order to determine estimates of the MHTC-proposed revision to Massachusetts revenue cap, we used data for “total state taxes” from all online Department of Revenue Annual Reports from Fiscal Years 1986 to 2024.3 For the rest of the calculation, we use Massachusetts’ average wage and salary amounts published by the U.S. Bureau of Economic Analysis as prescribed in the original law language.

To determine the total amount of refunds under the existing cap and proposed revision scenarios, we added up all instances the cap was less than the actual revenue collections reported by the DOR, and then added the sum of those differences to calculate the total amount over the history of the law that should have been returned to taxpayers. Allowable revenue limits under the existing law were taken from the DOR.5 To estimate an average amount per taxpayer that should have been returned since 1987, we divided this sum by the latest estimate of the number of Massachusetts taxpayers by the Internal Revenue Service Statistics of Income data (last released for tax year 2022).6 This data is not available going back past 2010, so we use the average for 2022 taxpayers as a proxy to understand the relative differences in refund effects between the two caps.

Because we are looking at what the estimated impacts would have been at the time, these numbers are taken from annual Department of Revenue reports and are not adjusted for inflation.

Finding 1: Under the current revenue limit calculation, Massachusetts taxpayers have only received two refunds in the last four decades. This amounts to roughly $833 per taxpayer in the history of the law.

Based on reporting by the Massachusetts Department of Revenue on certified “allowable” revenue limits, the state’s tax revenue collections have only exceeded this rate twice since 1987: Once triggering a refund of roughly $29 million back to taxpayers in 1987, and the second time triggering a refund of roughly $2.9 billion in 2022.

Finding 2: Since 2010, the rate of budget spending growth is roughly double the rate of growth for Massachusetts average wages or local inflation.

The total budget spending amount for each fiscal year since 2010 has grown 114%, according to state General Appropriations Act documentation. During the same time frame, Massachusetts average wages have grown at half the rate (roughly 62%) and inflation has grown even slower (roughly 42%).

Finding 3: Under the revised revenue limit rooted in actual tax collections, Massachusetts taxpayers would have received a refund 24 times in the last four decades. This amounts to nearly $19 billion in potential excess revenue that should have been given back to taxpayers.

Finding 4: Every year, the amount that would have been refunded would be different, but the average Massachusetts taxpayer could have received back roughly $5,320 if they paid taxes in Massachusetts for the last four decades.

Based on its 2022 refunds to taxpayers triggered by the existing DOR cap, Massachusetts disburses refund amounts proportional to the amount of taxes paid in the prior year. While individual tax liability determines how much each individual could receive,9 the per-taxpayer estimate for both the existing cap refunds and the revised cap refunds provides a comparison of how taxpayers could benefit under the proposed changes.

The following presents how much each taxpayer (based on 2022 Internal Revenue Service data) would have received since 1987 under the existing cap and under the proposed revised cap – had they paid taxes in Massachusetts since the existing law went into place.

Conclusions

Massachusetts is among several states that want to do right by taxpayers and provide reasonable constraints on spending. However, the existing cap on revenue the state is allowed to collect is not very effective at achieving this goal.

Since the current revenue cap went into place in 1987, state spending has ballooned faster than local wages or inflation, and tax collections are higher than ever.

Instead, revising this cap by benchmarking it with actual previous tax revenue levels would allow the law to effectively limit tax revenue collections, constrain the amount lawmakers can spend every year, and refund thousands of dollars in excess revenues back to taxpayers.