Potential Ballot Measures: Income Tax Cuts, More Taxpayer Refunds

Today, the Mass Opportunity Alliance (MOA) applauded policies outlined in two likely ballot questions filed ahead of the Aug. 6 deadline, the first step to getting both ideas put before Massachusetts voters next fall. Both proposals were inspired and informed by MOA’s original research and analysis.

The first idea: Cutting the income tax from five percent to four percent. The second: Encouraging fiscal responsibility by returning more money to taxpayers.

MOA released new research today on both policy reforms, including polling of Massachusetts voters and data analyses measuring the economic benefits of both ballot measures. Together, the two proposals would offer meaningful taxpayer relief and rein in state spending.

POLICY REFORMS WOULD BOOST STATE ECONOMY

A new MOA analysis found that lowering the income tax rate from five percent to four percent would save the average Massachusetts taxpayer roughly $1,300 annually compared to the status quo. Additionally, the tax cut would increase the Bay State’s gross domestic product (GDP) by as much as $17.5 billion within three years of the full tax cut. (View the policy brief here.)

MOA also studied the effects of imposing stronger limits on how much the state can collect from taxpayers. According to the report, had the proposed ballot initiative been in place, taxpayers would have received refunds 24 times over the last four decades, compared to the two refunds that were received under the current cap in the same time frame.

Under the new proposal, Massachusetts taxpayers could expect to receive thousands of dollars in future excess revenue refunds. (View the policy brief here.)

STATEMENTS FROM MOA LEADERSHIP

Christopher R. Anderson, president of the Massachusetts High Technology Council, one of the MOA co-founding groups:

“Over half of U.S. states cut their income tax rates beginning in 2021. Meanwhile, Massachusetts is the only state to increase its top tax rate since COVID, while also growing budget spending by roughly $20 billion—over 50 percent—in the last seven years. The policies presented in these proposed laws would help Massachusetts course-correct, providing much-needed tax relief and reining in the state’s out-of-control spending.”

Jim Stergios, executive director of Pioneer Institute, one of the MOA co-founding groups:

“Massachusetts needs to abandon the tax-and-spend mentality that’s making it harder for people and businesses to thrive. If we don’t do something to control state spending and bring relief to residents, data and experience show we will continue to bleed talent and tax revenue. We look forward to educating the public on these policies that encourage fiscal responsibility and ease the burden on taxpayers as the cost-of-living continues to rise.”

Jay Ash, president and chief executive of the Massachusetts Competitive Partnership, one of the MOA co-founding groups:

“Massachusetts has big problems impacting our state’s competitiveness, and MOA is dedicated to helping identify big solutions. The two policies outlined in these proposed laws begin to address the anti-competitive impacts of our high taxes and state budget growth. We’re excited to see individual taxpayers and business groups advance these ideas for consideration by the legislature and voters.”

VOTERS SUPPORT INCOME TAX CUTS AND REFUNDS

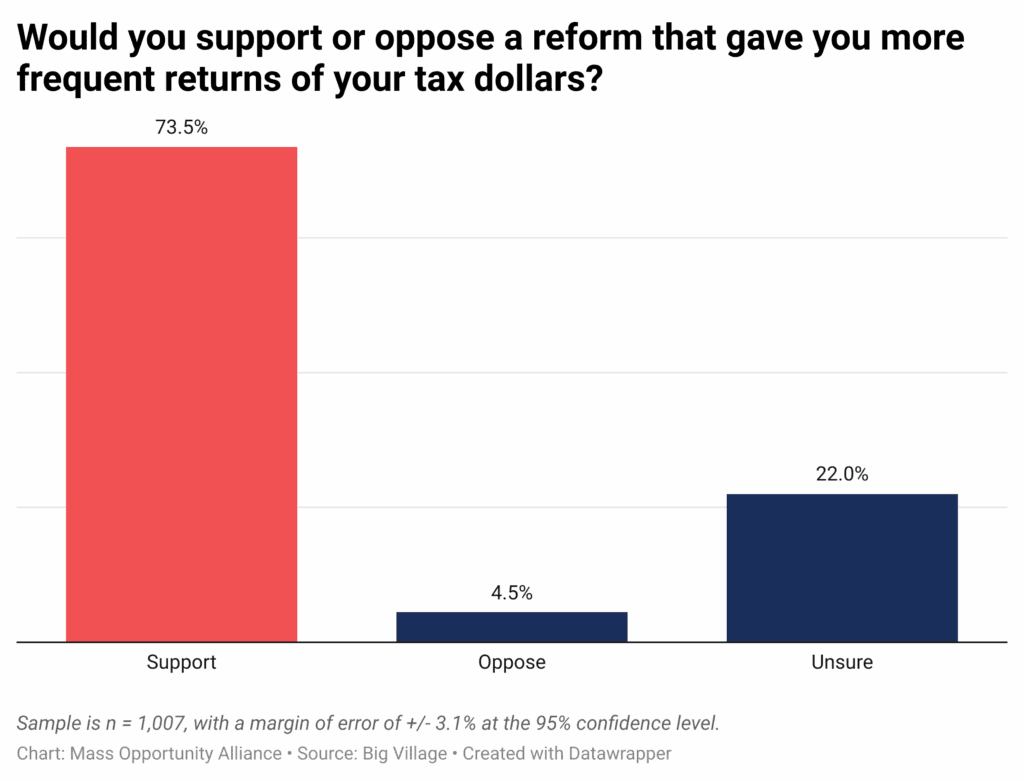

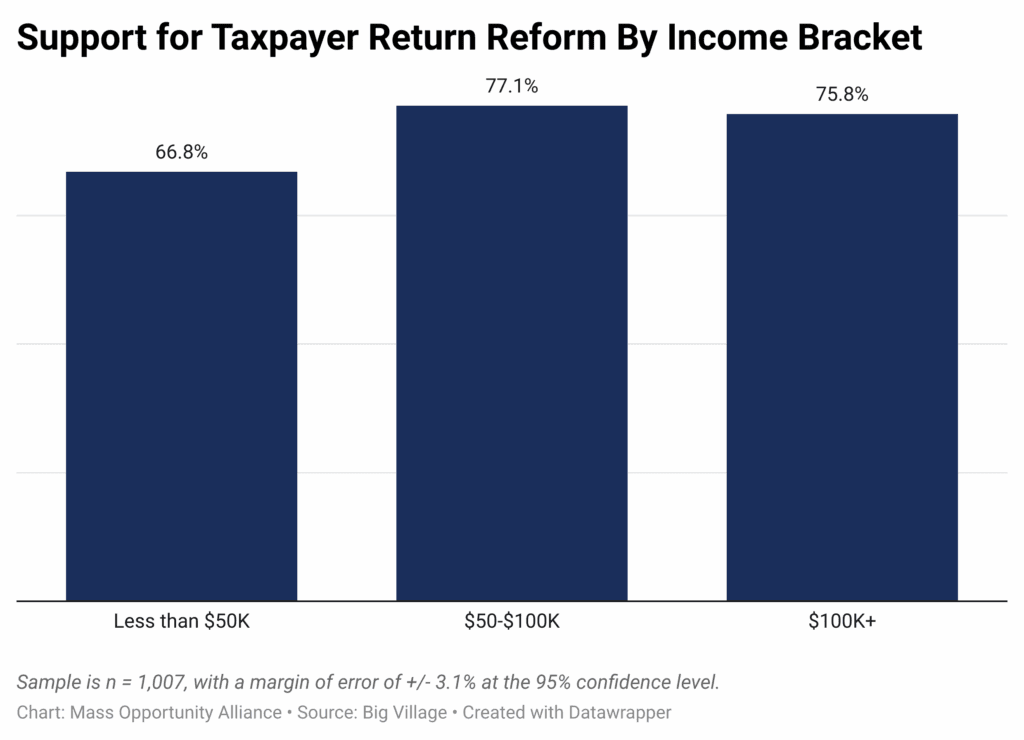

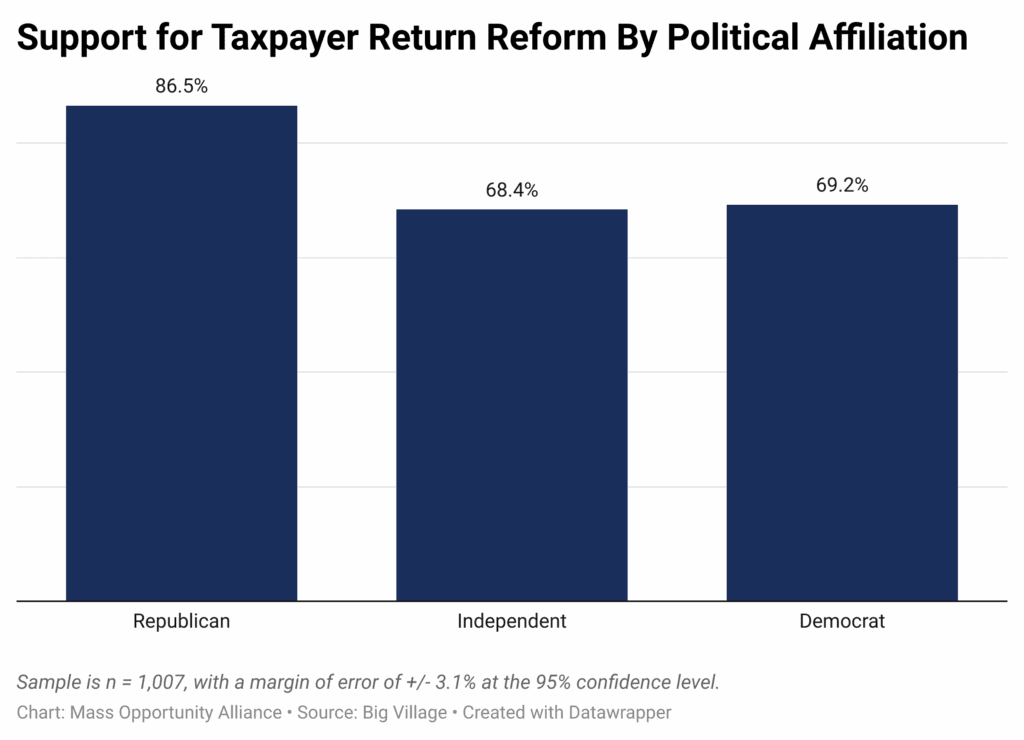

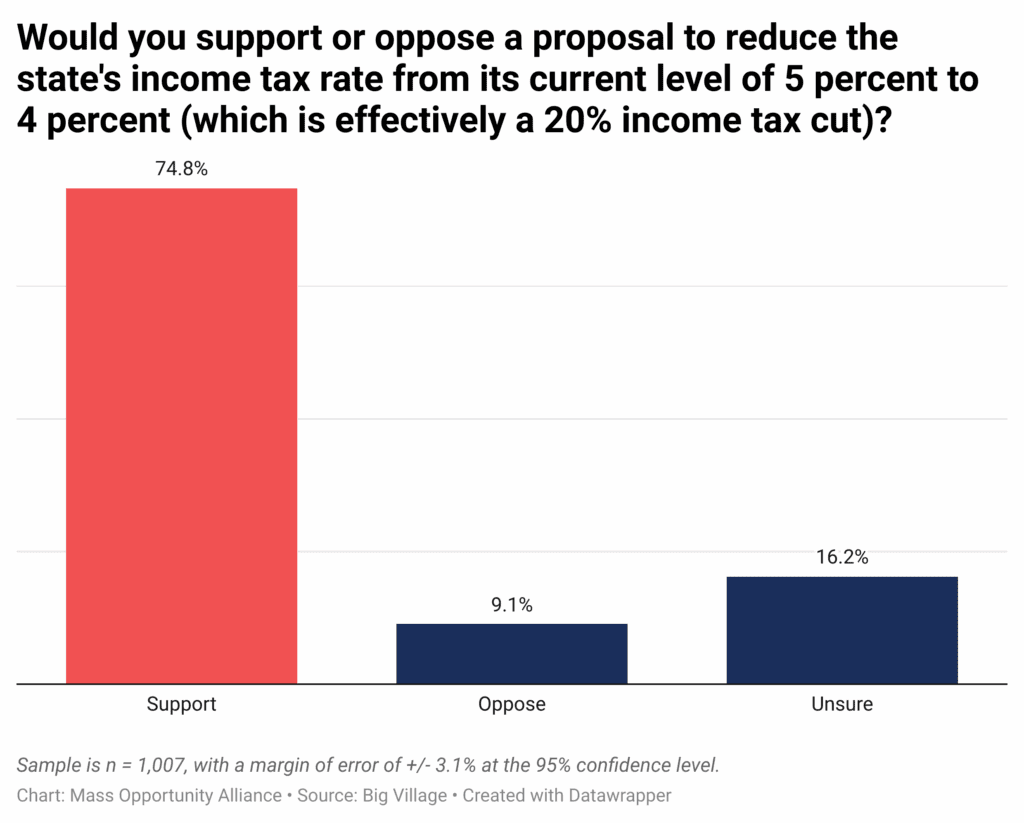

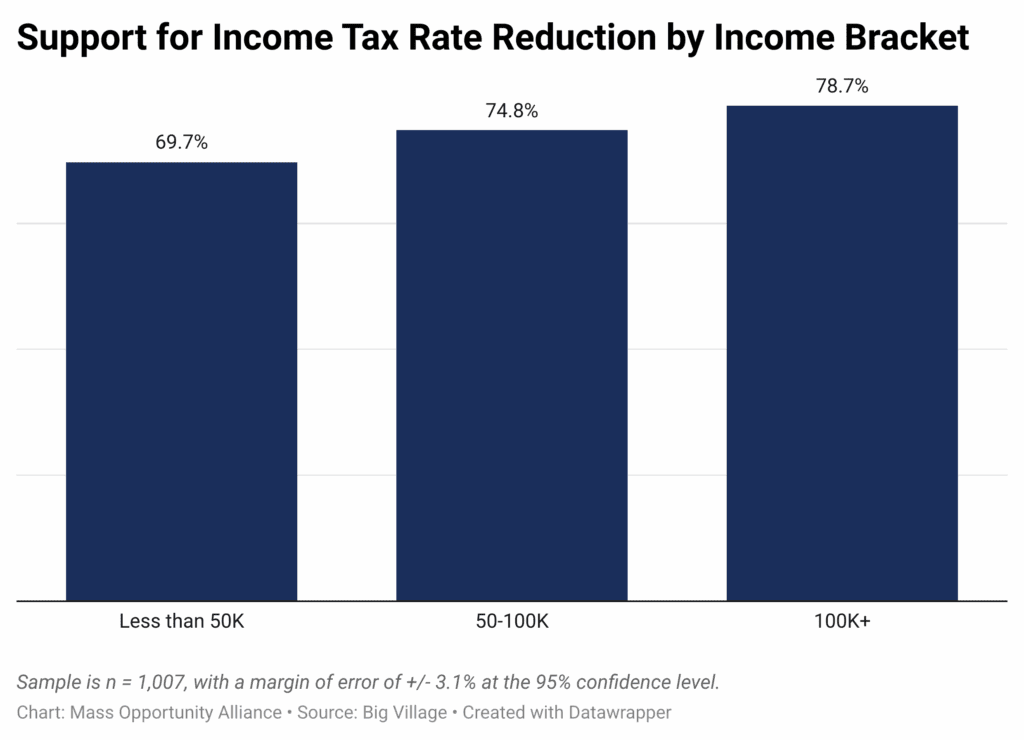

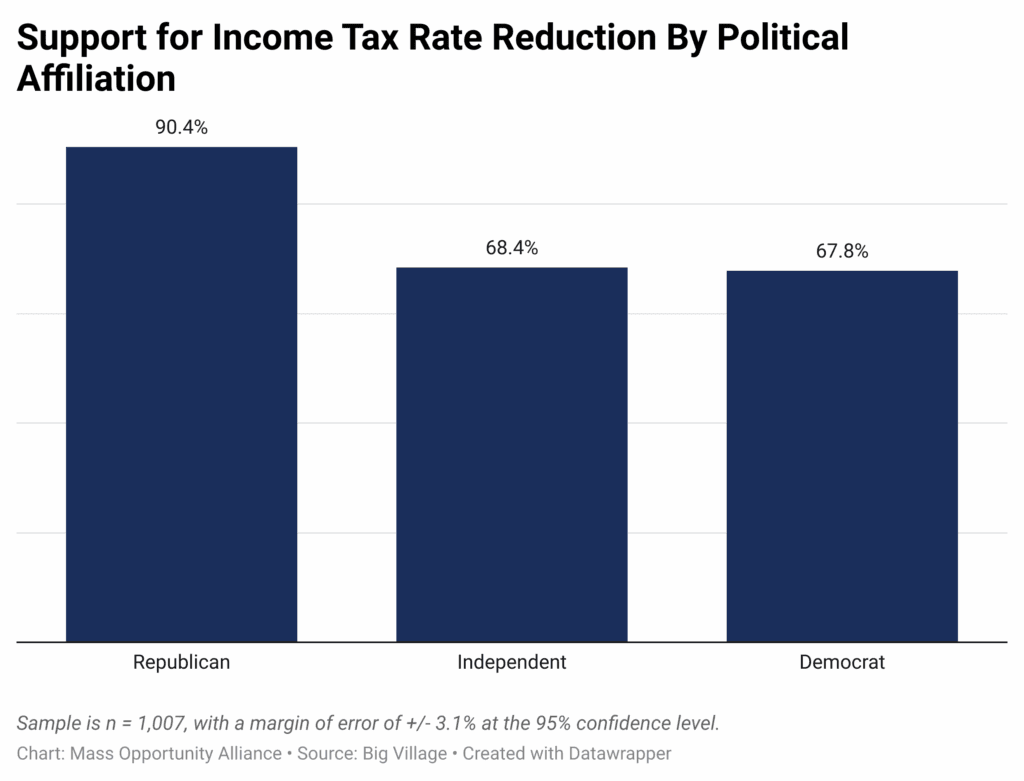

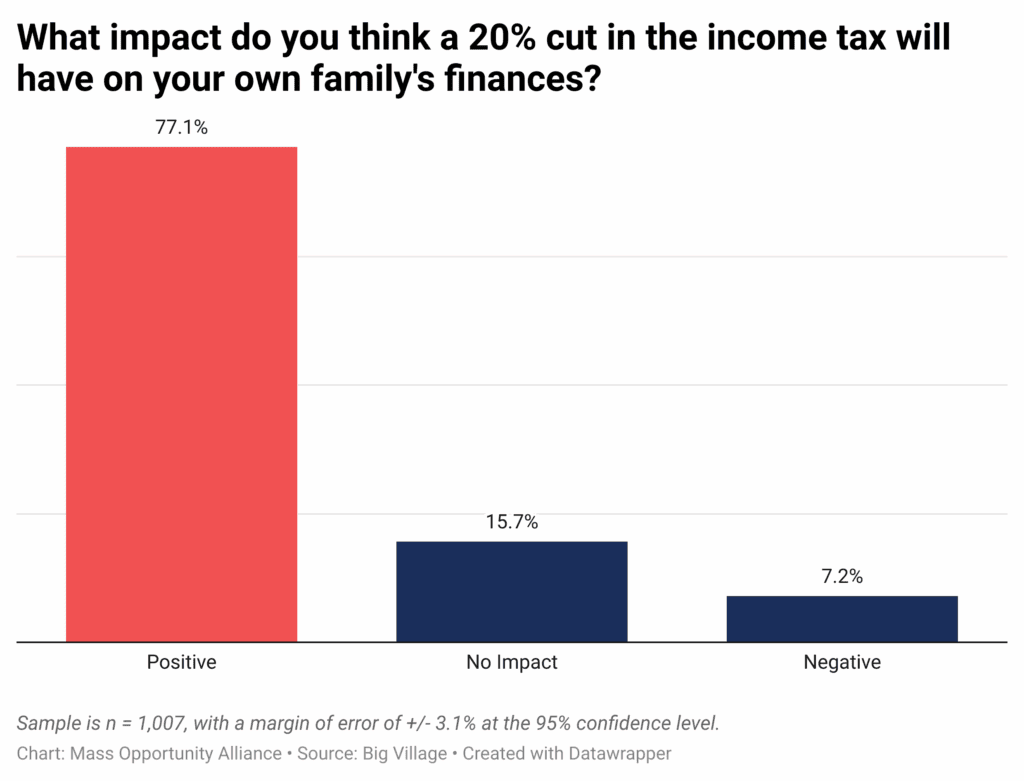

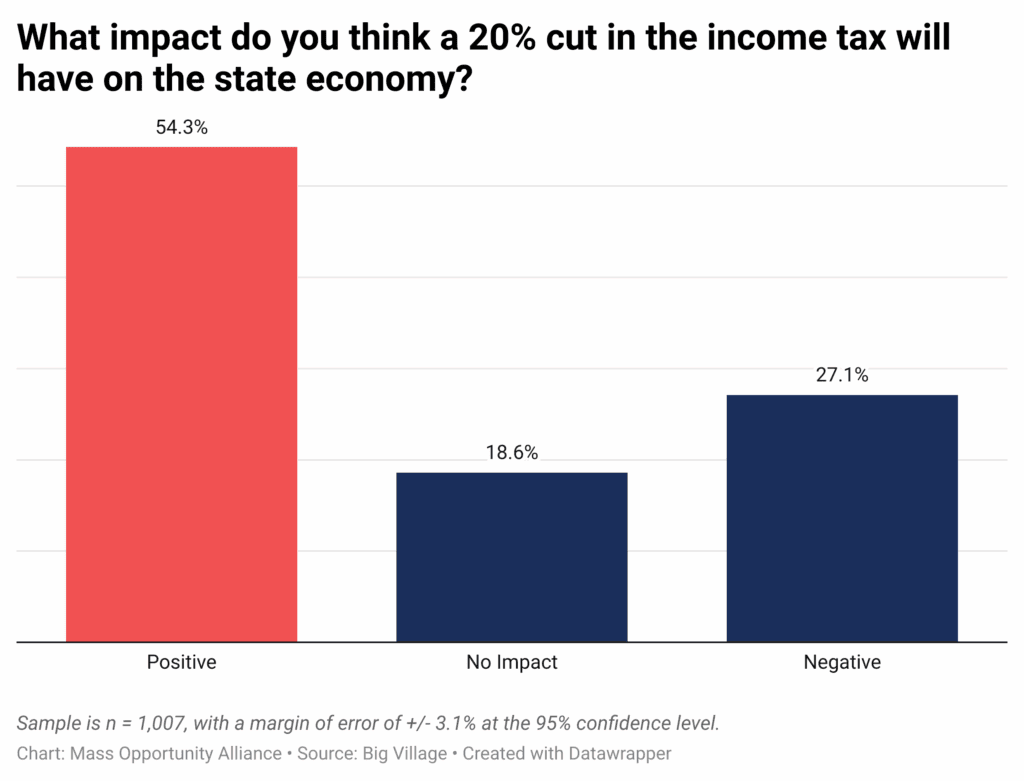

A new MOA poll of 1,007 registered Massachusetts voters found substantial public support for the policies outlined in these proposals across income brackets and party lines. The survey, conducted July 16-25 by research firm Big Village, has a margin of error of ±3.1 percentage points. (View the polling, including a demographic breakdown, here.)

Key findings include:

74 percent of respondents support a revised revenue cap to trigger more taxpayer refunds, including 67 percent of respondents with annual household incomes under $50,000.

75 percent of voters support the income tax cut, with 77 percent saying it will have a positive impact on their own family’s finances.

Full Polling Results

You can also view the full polling complete with methodology here.